Follow the smart money every day with institutional order flow

Identify institutional order flow price zones, see where capital is rotating and discover the strongest & weakest names. No hype—just clear signals you can act on.

Try STIX for $2.50Positioning, not prediction. Updates daily across US equities & ETFs.

The only platform with proven alpha.

Alternative data with a proven track record of alpha generation — validated by multiple algorithmic strategies—and available on‑demand for less than your caffeine‑fix.

View sample strat →

Why institutional order flow matters →

A simple top‑down order flow process

Start at the market, zoom into sectors and drill all the way down to the tickers with conviction.

Market Regime

Gauge trend, volatility & range in seconds to decide whether to trade momentum or mean‑reversion.

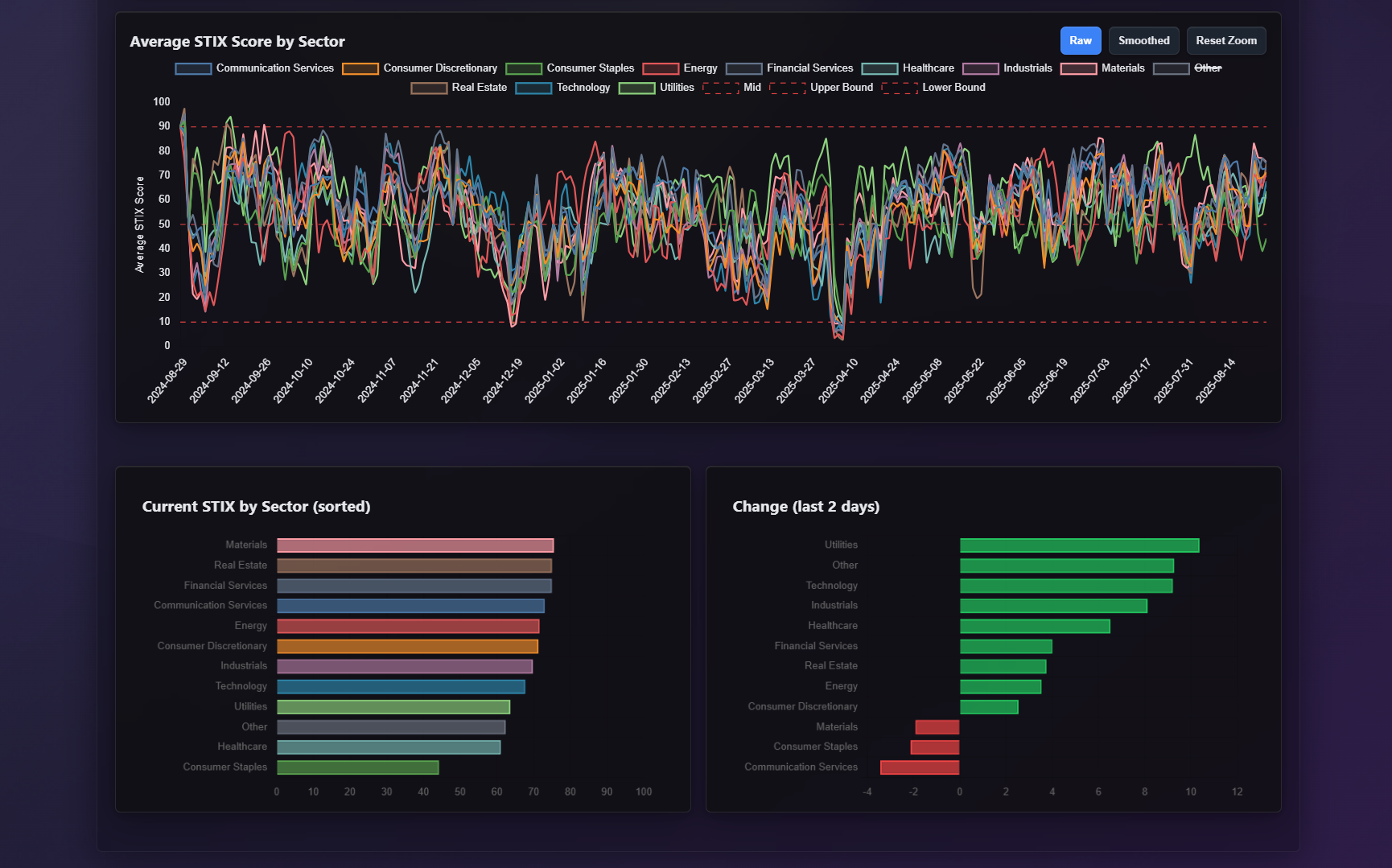

Sector Rotation

See where capital is actually rotating by sector and lean into leadership while sidestepping laggards.

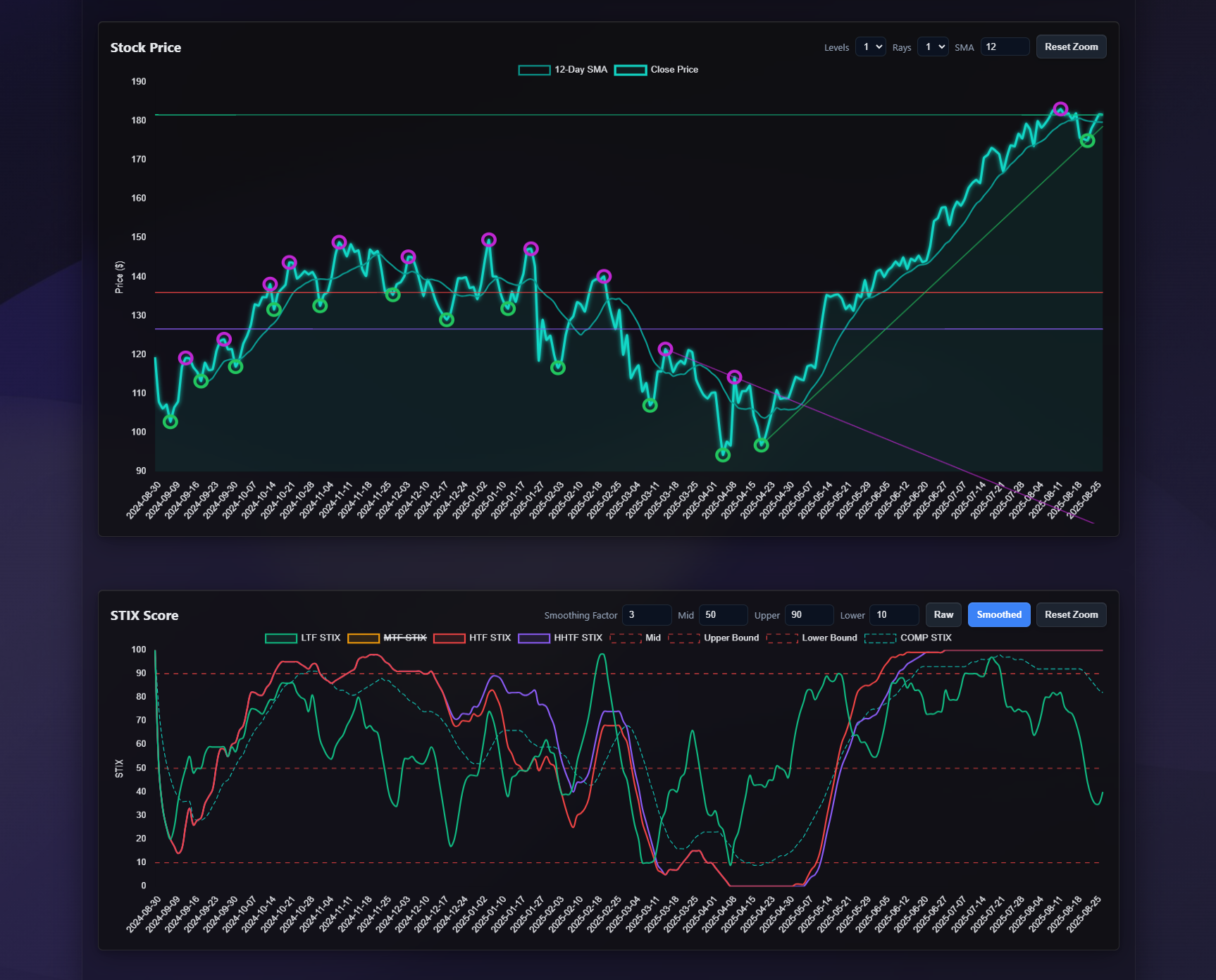

Ticker Levels & Scores

Overlay STIX on price history to spot institutional price zones and zero‑in on high‑probability entries.

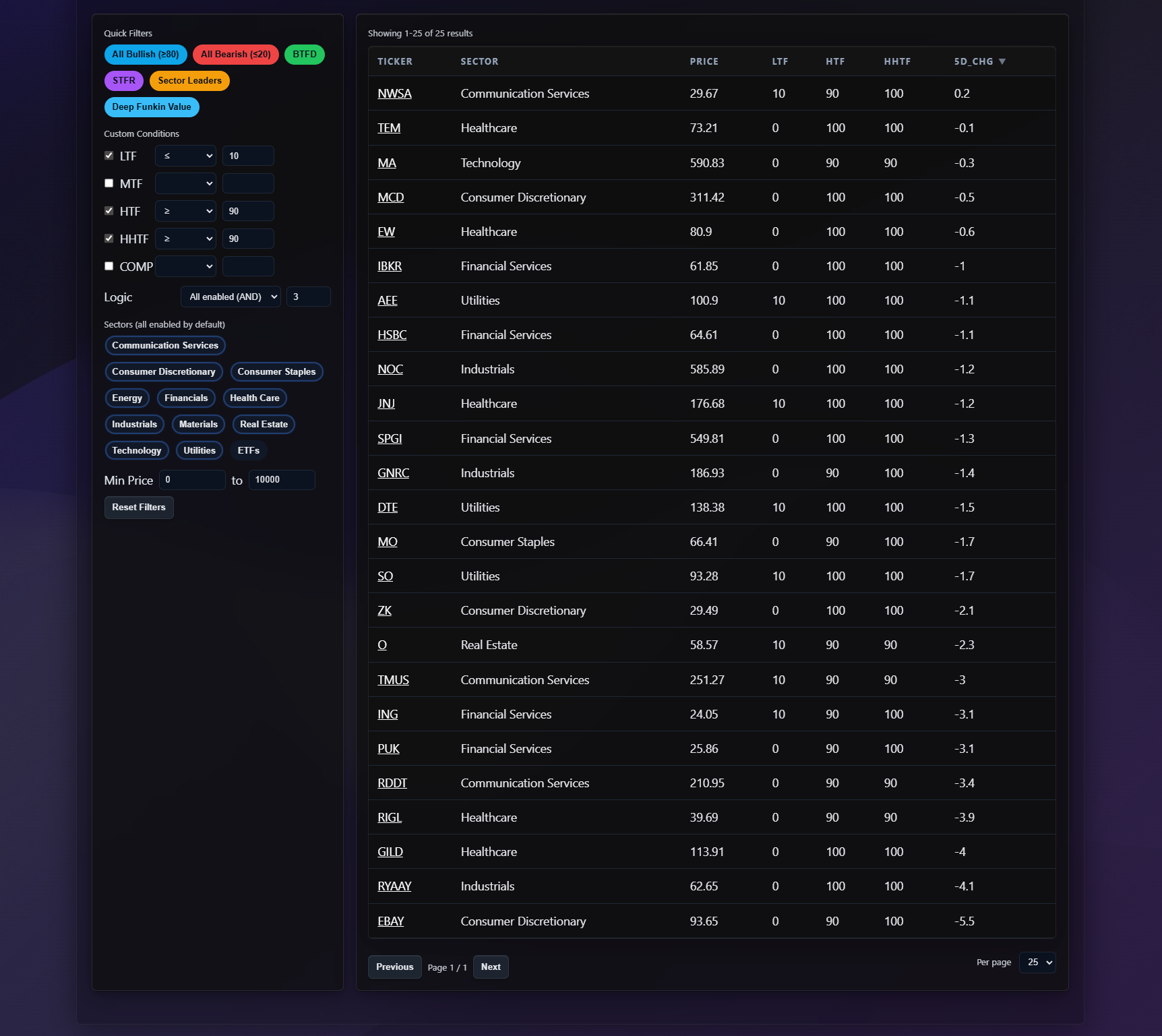

Opportunity Screener

Filter by timeframe, sector or custom watchlists to surface the structurally strongest (or weakest) names in seconds.

Leaders & Laggards

Instantly see the top and bottom names within any sector so you know what to pursue and what to avoid.

Get started in minutes

Instant access. No subscription. Immediate insights.

Pay once

$2.50 for a 24‑hour pass. No subscription that you'll forget about, no auto‑renew. Pay only when you need the data.

Get your code

Instant email with access credentials. Log in and start analysing right away.

Analyze any ticker

View price history with STIX scores overlaid. Most US stocks covered (Price > $10 with 500K+ daily volume; full coverage coming soon).

Simplify your trading. Strengthen your conviction.

Join traders using institutional intent to gain an edge. Pure alpha for the price of a coffee.

Money‑back guarantee

If STIX doesn't deliver what you expected, we'll refund your $2.50. No questions asked.

Already have an access code? Login here.

Enter your credentials to access the STIX tool